Fred Gluck is former managing partner of McKinsey & Company, Inc., and former vice-chairman and director of The Bechtel Group. He is the presiding director of HCA and also serves on the boards of Amgen, RAND Health Care, and New York Presbyterian Hospital; and is an advisor to a federal budget project of The Brookings Institution. Dave Wenner contributed substantially to the thinking reflected in this piece.

The United States health-care system has been remarkably effective in developing powerful new modalities (education, drugs, devices, procedures, etc.) to combat disease and illness and extend life. Nevertheless, our current approach to delivering health care is both unsatisfactory and unsustainable. Simply stated, our delivery of these modalities is done with mixed effectiveness, and we now face the prospect of being able to deliver more health care as a nation than we are able to afford without compromising our ability as a nation to provide the other needs of our modern society. As a result, we eventually will have to come to grips with the question of how to manage our health-care system more efficiently and effectively, and in a way that permits us to fulfill the other competing needs of our society.

Some have suggested rationing as the solution. In fact, we already ration health care but in a passive way that is not only inequitable in the minds of many but also inefficient and, because of complexity and hidden subsidies, almost impossible to understand. Others believe that improving efficiency is the key. There are undeniably great opportunities to improve the efficiency with which we deliver health care. Some of these opportunities are the unintended consequences of past policy decisions (e.g., what kind of government and private insurance should be provided to various segments of the population and by whom, and how to control malpractice) that have shaped the conditions under which care is actually delivered to patients. The problems that have created these types of opportunities are systemic problems with the health-care system.

Many other opportunities to increase efficiency exist in the ways that patient care is actually delivered to individuals in doctors’ offices, hospitals and other settings. These are patient-care delivery system opportunities. Capitalizing on many of these opportunities would require substantial changes in long-established and deeply embedded physician behaviors that are notoriously difficult to change. The situation is further complicated by exogenous factors: the pace of technological change, the aging population and the increasing incidence of chronic disease. Any equitable and sustainable solution will have to address all the causal factors and is likely to require elements of both increased efficiency and rationing.

Attempts to address these problems by tinkering with the current U.S. approach to delivering health care have had only limited success, and have left almost all constituencies unhappy in one way or another. This is not surprising, when one considers the tremendous changes in medicine, life expectancy, and many other aspects of our society that have taken place in the 40 years since Medicare was enacted, and kicked off the modern era of American health care. By starting with a fundamental re-examination of the health care delivery system in the United States in light of these changes, we should be able to devise a framework for thinking about a more equitable, effective, and efficient way of delivering a high level of cost-effective health care to all Americans without guaranteeing all possible care to the entire population.

THE CURRENT SITUATION

Why the System is Unsatisfactory

There is a high degree of concern in the United States about our health-care system and its ability to meet the nation’s future needs. Three factors are driving this concern:

- Access: The fact that 45 million people are uninsured and perhaps an equivalent number are underinsured, which arguably leads to a much lower standard of care delivered at higher cost to these populations;

- Cost: The dramatically increasing cost of medical care and the financial stress it is putting not only on our federal and state budgets, but also on the private sector (employers and individuals); and

- Quality: The findings of the Institute of Medicine that much medicine practiced in the United States is of sub-par quality.

Why the System is Unsustainable

These concerns are extremely well-founded when one considers that the annual per capita cost of medical care has risen from about $150 at the end of World War II to more than $6,000 today, and this cost shows no sign of leveling off. (In fact, while median per capita income (in current dollars), has grown substantially, per capita health care expense has far outpaced it and has moved from about 4 percent of median income to almost 15 percent since 1970. This trend is rapidly putting the costs of assuring themselves access to health care out of the reach of many Americans.

Moreover, as a nation, we spend 16 percent of our GDP on health care with apparently no better results than other nations that spend half as much. In fact, government spending on health care is approaching 8 percent of GDP and 25 percent of the federal budget. In addition, for the last 40 years, spending on health care has grown by an average of 2.5 percentage points faster than GDP growth. And, by the year 2040, we will have only two workers per Medicare beneficiary, compared to about four today. If these trends continue, the federal government will spend 18 percent of GDP on health care alone by 2040—more than the total of all current federal government revenues. And our total national expenditures will approximate 40 percent of GDP.

Underlying causes of the problems

The underlying problems are partly systemic (the context in which we administer health care – insurance, tax policy, bureaucracy and litigation), partly in our patient care delivery systems (hospitals, doctor’s offices and other delivery sites) and partly exogenous factors.

Systemic problems

The systemic problems include:

- The consequences of our willingness to tolerate a system that leaves so many of our people either uninsured or underinsured: Much of their care is delivered through emergency rooms. This approach is notoriously demeaning, inefficient, and disruptive to the true function of the emergency facility, and frequently delivers too little, too late at much higher cost. In addition, the costs of this care are dumped on the private sector through a variety of hidden cross subsidies and artificially inflate the cost of health care as perceived by the private sector.

- The degree to which our insurance programs encourage excessive demand. [1] Much of our health insurance covers the full range of modalities available and effectively entitles consumers to demand any service covered regardless of the expected benefit. In effect, we have pre-paid health plans (“licenses-to-spend”) in both the public and private sectors that insulate the consumer from the direct cost of care and result in uncontrolled demand for unnecessary or marginally effective modalities. Efforts to contain these demands through the use of deductibles and other cost-sharing techniques have had mixed success in decreasing demand for the high cost modalities and by discouraging patients from seeking care early in the disease cycle may be doing more harm than good.

- The regressive nature of our employer tax benefits: Because tax deductions for employers are passed directly through to employees as the equivalent of tax free compensation to pay for health insurance these deductions effectively provide subsidies to the most financially well-off segments of our population—those people with steady jobs and good salaries—while ignoring lower-paid and hourly workers, the unemployed and many people working part-time or for small companies. This approach not only creates much of the consumer-insulation problem but costs government about $210 billion annually in foregone tax revenue that could be better used to subsidize the more disadvantaged segments of the population. [2]

- The extraordinary complexity of the system: the current system is in fact an extremely complex collection of systems at the federal and state level focused on making millions of individual decisions on who will be subsidized and for what. This has led to substantial cross-subsidies, excessive bureaucracy, and a plethora of other inefficiencies and inequities and provides a formidable obstacle to constructive change.

- The litigious way we handle malpractice: This has led to skyrocketing malpractice insurance costs and very large settlements that have, in turn, driven doctors and other providers to practice unnecessarily defensive medicine and generate even greater costs.

These systemic problems have contributed greatly to causing costs to spiral out of control and are a substantial impediment to bringing about necessary changes.

Shortcomings in the Patient Care Delivery System

These shortcomings include:

- The high incidence of providers delivering medicine that is not consistent with current best practice: Failure to practice evidence-based medicine contributes to both the cost and quality problems. A recent RAND study has indicated that this phenomenon might constitute as much as 30 to 40 percent of medical practice and can lead to both overuse of ineffective modalities and underuse of effective ones. Both phenomena lead to lower quality and higher costs in the long run.

- The highly fragmented nature of the delivery system and the absence of any center of initiative for driving innovation in it. The broad outlines of the patient care delivery system have been relatively unchanged for the last century. There has been no systematic and continual value engineering of either clinical practices or the ways administrative and support activities are carried out in hospitals, doctor’s offices and other delivery sites. As a result, there are very substantial variations in both the cost and quality of care from doctor to doctor and facility to facility. The slow and uneven pace of dissemination of best clinical practices (e.g. open heart surgery procedures) and best support techniques (e.g. use of information technology) as well as the lack of reliable comparative information on costs or quality are all good examples of this phenomenon

There are significant opportunities to improve the patient-care delivery system, but because the system is so decentralized, best practices are hard to identify and even harder to disseminate. Moreover the medical profession is reluctant to depart from traditional modes of operation and embrace new approaches. Nevertheless improving the patient care delivery system will be an essential part of improving quality and bringing costs under control.

Exogenous Factors

Exogenous factors include:

- Dramatic increases in the range and sophistication of available treatments for people of all ages: These new modalities are primarily the result of advances in medical technology. One of the most striking effects of this proliferation of modalities has been a very significant improvement in our ability to treat and contain a wide range of chronic conditions and a concomitant and dramatic increase in the costs of treating them.

- A monotonic increase in life expectancy, largely because of the tremendous success of medical technology and improved education: By 2040, approximately 20 percent of our population will be over 65, compared with 12 percent today. People over the age of 65 consume substantially more health care than younger people. For example, it has been estimated that people between the ages of 65 and 85 consume more than three times as much health care as people who are 40 years old, and people over the age of 85 consume more than seven times as much.

- The consequences of our self-indulgent life styles: These have led to an increased incidence of certain unhealthy chronic conditions (e.g., obesity) and diseases (e.g., diabetes and lung cancer) and are largely responsible for continual increase in the costs of treating chronic conditions as a percentage of total health care expenditures.

The first two of the exogenous factors are what one might call high-class problems. They reflect the marvelous success of our country’s investments in medical technology, and could lead to a healthier, longer-living population. Or they could lead to a population increasingly composed of elderly people being sustained in an extended process of dying by massive expenditures on technology. Or, more likely, some mix of the two. Therein lays the potential problem of rationing. We need to put a process in place for addressing these somewhat longer term, but apparently inescapable, moral and ethical challenges. The third exogenous factor is a cultural phenomenon that can be addressed through a combination of incentives and education.

Summary of the Current Situation

The current situation is very uncomfortable, and predictably one that our politicians and almost everyone else is loath to address. Many people would take the position that health care is a right and should be available to everyone. On the other hand, health care is also an economic good (as are education, water and electricity, and fancy cars), and, to make it available, capital must be invested and people must be recruited, trained, and deployed. Materials must be consumed. But, in the end, the benefits received for investments of time, money, and people must justify the expense of providing them—whether it is for health care or fancy cars. If the expense is a relatively small or a manageable portion of a nation’s output, as it was when Medicare was instituted, health care might be treated as everyone’s right—although we have never done that. On the other hand, when health care begins to compromise our ability to meet the other needs of our society and our people, we need to begin to think about how it will be allocated.

As technology continues to advance and our population continues to age, we will need to deal head-on with these problems or risk serious financial consequences. The cost problem has two dimensions: total cost to the economy of health care and the subset that consists of government-subsidized programs. Both can be dealt with by addressing the systemic problems that lead to excess consumption and attacking the inefficiencies in the patient-care delivery system. In addition, governmental spending will have to be dealt with through a process that will lead to sensible, equitable, affordable, and politically acceptable decisions on what and whom government should subsidize. The ethical and moral dilemmas that choices like these raise will only become more challenging as the population ages and medical technology advances. Unfortunately, under our current system, the free market is substantially distorted by cross-subsidies and government decisions on what and who to subsidize have become episodic, highly politicized, and extremely contentious.

If we return to the three areas where we identified our performance as unsatisfactory, we can summarize the current situation as follows:

- Access: The access problem is largely caused by the schizophrenia of the government about providing care to those who can’t afford it. In other words requiring the private sector (including the non-profits) to take care of the disadvantaged (through charity and bad debt write offs) but refusing to pay for it. Solving this problem will require that the government assure that each person in the United States has access to a high level of health care. One way to do this would be to mandate that all Americans be covered by health insurance for all true emergency care, all preventive measures, and for all chronic and long term care and unexpected and extraordinary medical expenses that meet certain benefit and cost criteria. Routine care would not be covered by this insurance. Because the cost of such insurance has outpaced the ability of large segments of the population to pay for it, the government will either have to provide this insurance directly or subsidize its cost if it is provided by the private sector. Routine care will also have to be subsidized for some. Our current practice of subsidizing primarily the middle and high income segments of the population through the tax preference for employer sponsored insurance (ESI) is misdirected and must be eliminated. Redirecting these subsidies will go a long way to financing improved access for all.

- Runaway costs are being driven by a number of factors including inefficiencies in providing care to the uninsured, misguided subsidies, an incomplete system for approving new modalities and the counterproductive forms of insurance that exploit it, a fragmented and inefficient patient care delivery system, the ineffectiveness of our approach to handling malpractice and the growing incidence of chronic conditions caused by unhealthy life styles.

The cost problem is best thought of as having two dimensions – costs borne directly by private citizens and costs borne by the government in the form of subsidies (direct and indirect). Costs borne directly by private citizens are less of a concern as long as they are making sensible decisions on relative priorities among health care and other expenditures. (It’s a free country). On the other hand, subsidies provided by the government must be more actively managed because they can distort both the patient’s and the provider’s decision making process and result in unnecessary expenditures (which they do); and because they could eventually cripple the ability of the country to finance other priority spending areas if not brought under control. Solving the government spending problem will require eliminating (or at least substantially slowing down) the difference between the rate of growth of health care expenditures and GDP.

This, in turn, will require

- Ensuring all Americans are covered by appropriate health care insurance.

- Limiting subsidies to people who require them (as described in the discussion of access above).

- Limiting subsidies to modalities that are cost effective on both an individual and societal basis.

- Redesigning our approaches to dealing with malpractice.

- Addressing the problems of inefficiency in our health care delivery system. (See further discussion of this need in the Quality section below.)

- Educating the public about the dangers of damaging lifestyles and providing incentives for responsible behavior.

- QUALITY: The main determinants of quality of care are access, the capability of the people delivering the care, the modalities they have at their disposal, their skill in selecting the most appropriate ones and the timeliness of their application. All of these factors are embedded in the patient care delivery system and can only be influenced over relatively long periods of time with concerted effort on the part of many constituencies and institutions. Moreover, as noted above, the process of change is made considerably more difficult by the decentralization of the delivery system and the traditional resistance of medical professionals to change. Improving the quality of care will require a redefinition of the responsibility of the federal government to encompass a strong national capability to systematically analyze the shortcomings of the current patient care delivery system and conceive of better approaches to developing the required people and institutions to deliver it. This effort is crucial to addressing both the cost and quality issues.

Taken together these problems have produced an approach to delivering health care that is not only inequitable and of mixed quality but is also excessively costly and wasteful and so riddled with complexity, hidden cross subsidies and inconsistencies that a comprehensive redesign is a necessity. The basic philosophical underpinning for this redesign will be the commitment of the government to providing access to a level of health care that will meet the great majority of a person’s lifetime health care needs without guaranteeing access to all possible modalities in every situation. This redesign will require both changing the way insurance is provided to the population and building a national capability to manage and adapt this revised insurance system, to reshape the patient care delivery system and to influence and motivate the American people towards more health conscious life styles.

RESTRUCTURING INSURANCE TO PROVIDE UNIVERSAL COVERAGE

Defining the mandatory policy

A person’s lifetime health care needs can be divided into three categories

- Preventive measures: e.g. inoculations, PAP smears, mammography certain laboratory tests, colonoscopy, carotid scans, flu shots, indicated annual checkups.

- Extraordinary and unexpected expenses: episodic emergencies (e.g. heart attack, appendicitis, interventional cancer treatment, broken bones), serious chronic diseases (e.g. diabetes, cardiovascular disease, cystic fibrosis, lupus, muscular dystrophy), certain diagnostic procedures (blood tests, CT scans MRI’s, urinalysis) and long term care.

- Routine care: certain doctor visits, non-prescription drugs.

The mandated insurance would provide coverage for preventive measures and the treatment of extraordinary and unexpected. The decisions on what modalities to include in the mandated coverage can and should be made by professionals based on careful benefit/cost analysis of the scientific and economic evidence and consideration of the ethical issues.

Routine care would not be included in the insurance coverage since the need for it is certain if not predictable and the decision on when to pursue it can only be made by the individual in question or some responsible party (e.g. a parent) on the basis of that individual’s immediate situation. In other words the need for routine care is to be expected and the decisions on when to seek it are highly situational, subjective and discretionary and do not lend themselves to the same level of prior benefit/ cost analysis described above. On the other hand routine care is often necessary and beneficial and so some way to ensure access to it for those who cannot afford it is also necessary. HSA’s and HRA’s attempt to deal with this problem but suffer from the same regressive problems as ESI. An alternative way to assure access to routine care will be discussed in the section on subsidies.

The insurance pools for this coverage would be national by age cohort and the risk would be based on a national risk pool for each age cohort.[3] Preexisting conditions would not be considered in setting individual premiums but would be included in the designated premium for the age cohort as a whole.

This policy would then replace all government subsidized insurance programs including Medicare, Medicaid and SCHIP and all employer provided insurance. Subsidies would be provided (on a sliding scale) to the low and middle income segments of the population. Policies would be written for individuals and be completely portable although premiums would be grouped for billing to the head of household. All income of members of the covered household group would be consolidated in figuring subsidies.

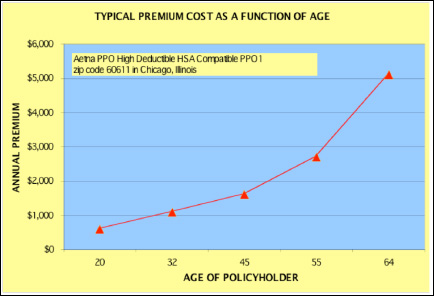

Chart 1 shows how the cost of a typical HDHP policy varies with age assuming no prior medical conditions but also assuming purchase on an individual basis (no group discounts).

Chart 1 Sources: ehealthinsurance.com, author calculations

The total cost of insuring the entire population of the United States between the ages of 20 and 65 (about 183 million people or 61%of the population) using this policy would be about $385 billion dollars[4]. Adding another $100 billion to allow for incorporating preexisting conditions into the rate for the cohort for each age group brings the cost to $485 billion. Costs of insuring the population below age 20 (about 78 million people or 26% of the population) would be of the order of $25 billion. Estimating the costs of insuring the population above 65 (about 39 million people or 13% of the population) simply using current Medicare spending for the estimate would be about $340 billion.[5] That gives a grand total of $850 billion for insurance for the total population. Assuming that 90 % of Medicare funding (36 million people) and 40 % of the rest of the population (about 105 million people) would be subsidized brings the total government cost for the insurance program to about $575 billion. Assuming another $100 billion to cover out-of pocket costs for routine care[6] for the subsidized population brings the total government cost to about $675 billion or slightly over $2250 per capita and certainly well below current spending levels[7]. These are, of course, very rough calculations but it seems entirely plausible that a high level of access to health care using a policy based on an HDHP program can be provided to the entire population for no more than we are currently spending per person and probably somewhat less.

The trick will be to design a program that encourages people to seek care early in the disease stage but not overuse routine care; drives physicians to follow best practices and effectively rations modalities that have low expected benefit/cost ratios.

If one hypothesizes about what a correct ranking of government priorities for selecting modalities to be included in the mandatory coverage on a cost/benefit basis might look like, one might conclude that—all other things being equal:

- All proven effective preventive measures (e.g. vaccinations, flu shots) should be mandatory.

- Modalities that produce cures or extend productive or satisfying life significantly should take precedence over modalities that simply extend the process of dying.

- Less expensive modalities of approximately equal efficacy should take precedence over more expensive ones ( generic vs. prescription drugs, lower cost simpler prosthetic devices over more sophisticated, more expensive ones)

- Health-related modalities (e.g., Lipitor, stents) should take precedence over lifestyle modalities (e.g., Viagra, cosmetic surgery);

Other rankings are more complicated. For example:

- When is pain relief a higher priority than life extension?

- Is a person who has led a healthy life more entitled to subsidies than a person who knowingly has pursued a lifestyle that leads to serious health problems (e.g., smoking, obesity)?

- When should we favor preventive over curative modalities?

- How does one decide when the lifetime cost of subsidizing a seriously ill or handicapped patient exceeds a society’s responsibility to provide subsidies?

- How does one analyze or make judgments about the relative societal cost-benefit of very expensive modalities for the aging population versus relatively inexpensive modalities for children or people of working age?

Following the philosophy implicit in the considerations above should lead to a basic, mandated policy that:

- Provides comprehensive coverage of preventive measures and necessary routine care.

- Covers all emergency situations (broken legs, heart attacks) and primarily life extending modalities (open-heart surgery, statins)

- Covers all chronic conditions (with perhaps some exclusions or limitations on coverage for conditions caused by egregiously irresponsible life styles).

- Covers appropriate long term care and end-of-life care but not modalities that primarily extend the dying process.

- Utilizes the least expensive modalities of approximately the same efficacy (e.g. generic drugs, simpler, less expensive prosthetic devices).

Designing such a policy will be a challenge and, naturally, we would all like the need to make making such difficult and value-laden decisions simply go away. And if the costs of providing all available health care to all who needed or wanted it were not becoming an unbearable social burden, we would not have to. Unfortunately, as discussed above, the tremendous success of our efforts in medical research and education most likely will preclude that eventuality.[8]

Eliminating tax preferences for Employer Sponsored Insurance

The problem with the ESI tax preference (and all tax based health care incentives) is that they are highly regressive and result in massive government subsidies to people who don’t require them. In effect this is merely recycling money that is collected through the tax system back to the people who paid it in the first place after siphoning off a hefty percentage for administrative costs. Eliminating it will create over $200 billion of new revenues to the government that will provide the necessary funds to provide the more sensible subsidies discussed below. Moreover as the next paragraphs explain this can be done with minimal impact on the employees affected. Finally it will relieve the employer of exposure to the kind of pernicious, uncontrollable (by them) expense that has caused so much grief to General Motors and others.

When employers provide insurance to their employees the employee is essentially receiving tax free compensation. The employer can deduct the cost of the insurance as a business expense but the employee does not pay taxes on it. If the ESI tax preference were eliminated, the employee would pay taxes on the amount at the marginal rate.

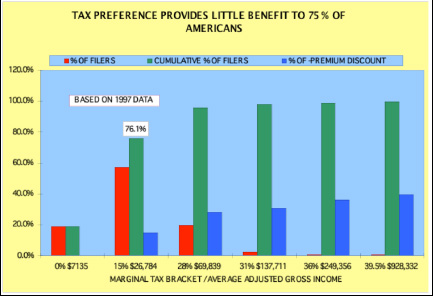

The bars in Chart 2 show the percentage and cumulative percentage of people (tax filers) who pay a given maximum federal marginal tax rate as a function of the level of marginal rate and the Adjusted Gross Income (AGI) associated with that rate. As indicated over 75% of people filing pay less than 15% at the margin. Thus if we were to tax the value of health care insurance[9] to employees, lower income groups would be minimally affected and even the highest income group would only pay an increment of about 40% of the total premium for their health care.

Chart 2 Center on Budget and Policy Priorities; Author calculations

Under the proposed system, the employer would continue to deduct the insurance payments for the new mandated policy but the value would be counted as income to the employee and he would be liable for the tax. Assuming the cost of the mandated insurance was equivalent to the existing policy, a filer earning less than $26,784 per year would actually experience an additional cost of only 15% of the policy cost. On the other hand if the policy were a less expensive HDHP as contemplated, the employee would very likely come out ahead. And if the employer passed on the difference between the policy costs as a salary increase (in other word keeping the financial impact on the employer at zero) the employee might well come out ahead. People in higher income brackets would be proportionately affected in the same way.

Taxpayers in the lower income brackets with high premiums would still find the cost of insurance problematic and would need to be subsidized. That brings us to our discussion of how to subsidize those Americans who need it.

Subsidizing Americans Who Need Help

In this system all of the subsidies would go to the lower- and middle- income segments. Of course, they would include most of the elderly, who generally have much lower incomes than the population under 65[10].

The premiums for the mandatory insurance program would be paid primarily through payroll deductions much as they are today. However, when a household’s premium costs exceeded a specified maximum the additional cost would be billed to the government. That maximum would be 4% for households at the 20th percentile of income or less (about $20,000) increasing an additional one percentage point starting at the 20th percentile up to 10 percent at the 80th percentile (about $80,000) and above. This would roughly be equivalent to subsidizing 1/2 of the total cost of the mandated program.

These deductions would be applied to the employee’s health-care costs until the mandated portions of these costs were fully covered. For example, a head-of-household earning $20,000 per year would have $800 (4%) deducted over the course of the year and paid to his or her insurance company.[11] This probably would not cover the costs of his or her mandated health care. The insurance company would then bill the government directly for the difference (or in the cases of the unemployed for the full amount). Adjustments for unearned income would be made by the IRS when income tax returns were filed.

Under this scheme, a household’s premiums would depend only on the number of people in the household and their ages. Since 90% of American households include 4 or fewer people, most household premiums (including HSA funding) would fall in the range of $2,000 or less (single young adult) to $10,000 (typical family with 2 or 3 children or a pair of adults approaching retirement age)

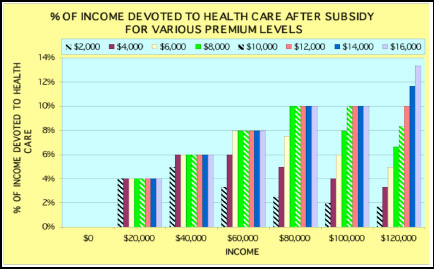

Chart 3 illustrates how the percentage of a family’s income devoted to health care would change as a function of the premiums paid.

Chart 3 Sources: author calculations

A family[12] of four (red candy stripe) with a premium bill of $10,000 and an income of $40,000 would pay a maximum of 6% or $2400 and the government would pay $7,600. The same family earning $60,000 would pay 8% or $4,800 and the government would pay $5,200. If it were earning $80,000 it would pay a maximum of 10% or $8,000 and the government would pay $2000. Above $100,000 there would be no subsidy. A single adult (green candy stripe) with a premium of $2,000 and earning $20,000 would pay her maximum of 4% or $800 and the government would pay $1,200. If she were earning $40,000, she would be paying 5 % (less than her maximum of 6%) and the full premium of $2,000.

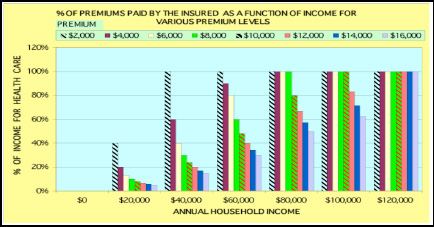

Chart 4 depicts what percent of its premium a household would pay as a function of the size of the premium and the household’s income.

Chart 4 Source: author calculations

The family of four with a premium of $10,000 (red candy stripe) with $40,000 in income would have reached its maximum payment of $2,400 (4%) and would be paying 24% of the cost of the policy. On the other hand, since over 75 % of American households are four or fewer people, the great majority of household would be paying the full premium by the time their income reached $80,000 (roughly the bottom of the top quintile).

Assessing the impact for the households that were formerly covered under ESI programs is a little more complicated. In other words although they will be paying the same percentages shown in the previous two charts they will have received the increase in income equivalent to their insurance cost so their effective cost of insurance is only the marginal tax rate as explained above. Moreover, the cap on percent of income for lower and middle income families will further cushion the impact on these households.

No American family transitioning from ESI to self-pay would pay more about 6% of their new adjusted wages for health insurance (assuming the same premium as under ESI) and most would pay considerably less. The subsidy curve could also be shaped to limit maximum cost up to the $10,000 premium level to 4% up to say an income of $100,000 without significantly affecting the total cost of the program. Americans who are currently self-payers or who are in companies with a small number of employees would benefit substantially from inclusion in the larger risk pools. Lower and middle income filers who are also self pay would also benefit from inclusion in the subsidy program. The low income uninsured (including all those qualified for but not enrolled in Medicaid) would all be covered. The higher income uninsured would have to acquire insurance and face the same potential obligations as their fellow citizens. The subsidy program would bring the mandated policy within reach of even the lowest income Americans.

In sum then the combination of shifting the focus of health care subsidies from the more affluent portions of the society (eliminating employer sponsored comprehensive insurance) and replacing it with mandatory HDHP for all Americans and income based subsidies provides the basis for a much more equitable and efficient program of government subsidies for the non-elderly. Those people currently enrolled in Medicare could either be transitioned into the program as well or grandfathered in the Medicare program. In either case, existing Medicare criteria for which modalities to cover would have to be made congruent with those of the new mandated policy.

BUILDING THE NATION’S CAPABILITY TO MANAGE HEALTH CARE

Three main initiatives will be required to build the necessary capability to assure the health care security of all Americans into the future a.) Shaping the health insurance and subsidy programs, b.) Reshaping the patient care delivery system and c.) Promoting healthier life styles. Creating the institutional capability to prosecute these initiatives will require the creation of a new, independent National Health Security Agency (NHSA). The agency would be designed for maximum independence from short-term political pressures (perhaps along the lines of the Federal Reserve Board or the Securities and Exchange Commission) to ensure its ability to safeguard the health of the country over the long term.

Since the Federal government will assume full responsibility for ensuring that the nation’s health care needs are met and Medicare will be replaced by the new mandated health care system both the state and federal Medicaid bureaucracies can be eliminated. Similarly much of the remaining federal bureaucracy would become obsolete under the new mandate and the much simpler and more direct approach to subsidizing health care. Some of this capability could be redirected to the new leadership roles defined for the NHSA.

Shaping the Health Insurance and Subsidy Programs

The NHSA would be empowered to control the cost of government subsidies by specifying the provisions of the individual basic mandated insurance policy, the funding to be provided and the specific populations to be covered. It would also be responsible for managing the national risk pools and negotiating arrangements with the insurance companies. This agency would work with the appropriate professional medical organizations to evaluate and rank all modalities approved by the FDA (modalities of proven efficacy) for their consistency with best practice and their relative benefit/cost both to the individual and the society. This will require building a team of physicians, economists and ethicists to work with the FDA and with professional medical organizations to resolve the knotty issues outlined in the prior discussion on the specification of the mandatory policy. Based on this information the NHSA would specify the provisions of the mandatory insurance coverage. The policy would be designed to cover the great majority of an individual’s lifetime health care expenses but would not cover extraordinary efforts to prolong the dying process or modalities of marginal benefit cost.

The agency would also specify which segments of the population should be subsidized and what the exact formula for determining the subsidy as a function of income should be[13].

Reshaping the Patient Care Delivery System

The NHSA would also be responsible for creating a new approach to monitoring and improving the quality and cost of our delivery systems, including bringing the costs of malpractice and defensive medicine under control. It would also be empowered to drive the process of value-engineering of clinical practices and administrative and support approaches in the patient-care delivery system

The task of reducing the costs and improving the quality of the patient care delivery system is a much longer term challenge. Most of the innovations that take place in patient care come either from the drug manufacturers or the equipment suppliers. Less innovation has taken place in value engineering the process of actually delivering health care. For example there are experiments (such as the use of hospitalists and nurse practitioners as ways to use lesser or specially trained people to accomplish tasks that were primarily performed by other practitioners) that although apparently quite successful move only very slowly through the system. This is partly because there is no comprehensive or organized effort to redesign the process or aggregate experience and accelerate the promulgation of improved practices. The NHSA should be designated and equipped to take on this challenge not only through a program of research and experimentation but also by leading and coordinating efforts by providers and funding and evaluating experiments in both clinical process and administrative innovation. In addition the responsibility for developing the measurements and systems to provide location by location comparative information on costs and outcomes should be a primary focus of this effort.

Improving Life Styles

There is compelling evidence that unhealthy life styles are contributing very heavily to the increase in the costs of taking care of chronic illnesses as a percentage of the total costs of health care. The most obvious examples are smoking and cancer and obesity and adult-onset diabetes. The concerted effort by the government to raise awareness of the American people of the hazards of smoking have already borne fruit and have included massive educational programs (advertising, labeling), negative incentives (heavy taxes on cigarettes) and positive incentives (discounts on health insurance for non-smokers). Stemming the increasing tide of chronic life style diseases will undoubtedly require similar and continuing efforts in other areas such as nutrition and alcohol and drug abuse. Hopefully the time will never come when we are forced to deny subsidized insurance to persistent offenders.

SUMMARY AND EXPECTED BENEFITS

The cumulative effect of all these programs would be to refocus the Federal government’s role on assuring all Americans access to quality health care while at the same time requiring all Americans to pay an appropriate share of its costs consistent with their ability to pay.

More specifically it would:

- Ensure that all Americans have affordable access to necessary, routine care and protection against catastrophic medical expenses (both episodic and chronic) through mandated insurance programs and subsidies targeted only to lower- and middle-income groups.

- Preserve the option for all Americans to seek additional levels of care or easier or more comfortable access to it if they are willing and able to pay for it either through supplementary insurance or direct payment to providers.

- Eliminate much of the incentive to demand unnecessary and/or marginally effective services and products through the design of the basic mandated policy and the elimination of government subsidies for unnecessary or marginally useful care.

- Preserve the essential structure of private medicine but eliminate much of the red tape associated with qualifying for government programs and the unnecessarily complicated billing and reimbursement systems they require and that are so de-motivating to our providers.

- Focus the attention of equipment manufacturers and drug companies on modalities with higher benefit/cost ratios.

- Greatly simplify the system, make it more user- and provider-friendly, and eliminate hidden cross-subsidies, and unnecessary and redundant bureaucracies and administrative costs.

- Make maximum use of existing payroll systems and the IRS to collect premiums and deliver subsidies greatly simplifying the cost and complexity of transitioning to the new system.

- Make much better use of scarce government resources (including eliminating the highly regressive employer tax benefits).

- Equip the nation to make rational, equitable, evidence-based decisions about both the current and future role of government subsidies through the new National Health Security Agency.

- Continually improve the cost and quality of the patient care delivery system, reduce the costs of malpractice, and remove the major incentives for practicing defensive medicine through the National Health Security Agency.

- Continually improve the health consciousness and life enhancing behavior of the American public through targeted programs of education and incentives led by the NHSA.

* * *

Our current health care system is both unsatisfactory and unsustainable. Acting quickly to stabilize cost growth through the policy changes recommended above will provide a much better context for delivering care. Empowering and equipping the NHSA to take charge of the continued adaptation of this context, of the patient care delivery system and of the health consciousness of the people will ensure its sustainability over the longer term.

[1] This problem proceeds partly from our approach to approving new modalities. The FDA approves new modalities based only on the efficacy of the specific modality in question (a role it carries out very well). The FDA does not explicitly consider the relative potential benefit/cost either to the individual or the society as a whole. As a result, these “license-to-spend” policies provide essentially unlimited access to modalities with little attention to the relative benefit/cost to either the individual or the society as a whole. Beneficiaries then put tremendous pressure on both insurers and providers to deliver all possible care. Moreover, this approach encourages the developers of new modalities to emphasize efficacy rather than benefit/cost with a high degree of confidence that the “license-to-spend” money will be there to pay for even the most costly modalities. As modalities become more and more expensive (and frequently of less certain absolute or relative value), the question of whether encouraging the provision of care in this manner can be justified either for the individual or on the basis of value to the society as a whole, becomes more and more central.

[2] This $210 billion government subsidy is generally not counted as a cost of government- subsidized health care.

[3] A national pool of this size should result in a very efficient insurance pool that would result in lower premiums than are postulated in this analysis. In order to circumvent the adverse selection problem the federal government could either assume the risk and use the insurance companies to administer the program or act as a re-insurer.

[4] This calculation was based on individual quotes for males of the specified age for a policy with medium deductible ($2750 individual) from ehealthinsurance.com for zip code 60611in Chicago, Illinois and does not include any group discount or premium for preexisting conditions.

[5] Data on costs for the HDHP policy are not available for people over 65.

[6] Providing routine care debit cards for those people who met certain income criteria for subsidy and placing a rolling 12 month limit of ,say, $1,000 on them. The extent of subsidy allowed would be calculated by the IRS in much the same way they dealt with the subsidies for insurance. This would provide a routine care safety net that was not regressive and could be implemented with a minimum of bureaucracy and cost.

[7] The most recent estimate of total U.S. health care spending (2005) is $2 trillion, of which government spending is about $920 billion. This figure does not include the $210 billion in foregone revenues from the tax preference for employer sponsored insurance. Medicare is about 17 percent, or $340 billion, and Medicaid and SCHIP are about 16 percent, or $320 billion. There are two other categories of government spending at the state, local, and federal level amounting to 13 percent or $260 billion. Including the foregone revenues for the tax preference given to employer sponsored insurance, total government support of health care becomes $1.09 trillion out of $2.17 trillion, or almost exactly 50 percent. That is about $3,500 per person.

[8] This process will require building a significant capability to evaluate the cost/benefit of each modality approved for efficacy by the FDA. This should probably be handled by an independent authority as discussed in the later section on the role of government.

[9] Under the new rules the employer would pay the employee in wages the equivalent of what he was paying the insurance company for health care benefits and the employee would be taxed on this amount. The insurance companies would separate their policies into a Part A (the mandated coverage) and a Part B (optional supplementary coverage). The employer would then deduct the premium for Part A (the mandated portion) and forward it to the insurance company for credit to the employee’s account. The employee would then decide if he wanted to purchase Part B at his expense and if so the employer would also deduct and forward the amount of the additional premium. Thus the incremental cost to the employee of the insurance would be her marginal tax rate applied to the insurance she chose (Part A or Part A plus Part B). This example assumes of course that the policy originally exceeded the mandated coverage but the analysis remains the same in the reverse case but the employee would be responsible for the cost of the improved coverage.

[10] Only about 12% of Medicare families had income of over $50,000 in 2002.

[11] If a person’s premium was less than the maximum amount for his salary which would tend to be the case with younger single persons, younger smaller families and high income families, the full cost of the premium would be deducted but no more. In other words the % cap would be a cap not a fixed % deduction.

[12] Under the proposed scheme insuring a family of four could cost somewhat more or some what less than $10,000 depending on the exact ages of the constituent members of the family.

[13] These decisions would be made in consultation with the Congress which would be responsible for determining what portion of government spending on health care was affordable.